Vacation time has arrived and malicious parties are extra active to swindle with phantom invoices, taking advantage of entrepreneurs who try to wrap up business just before going on vacation leave. Their "modus operandi" is applied at companies where temporal manpower is hired to take over the finance or accounting of the employee who normally makes these arrangements.

Your rush, their win

"Entrepreneurs are often slack due to holiday rush. Bills are often quickly handled just before the holidays, or there is less staff available. Scammers grab this opportunity to take advantage when processing the invoices," warns Dirk van Loo of financial legal service DAS. "Usually the amount invoiced is not very high, less than € 300. By paying insufficient attention to the invoice, a certain number of the phantom invoices are paid, making it easy money for the swindler."

What is a ghost invoice?

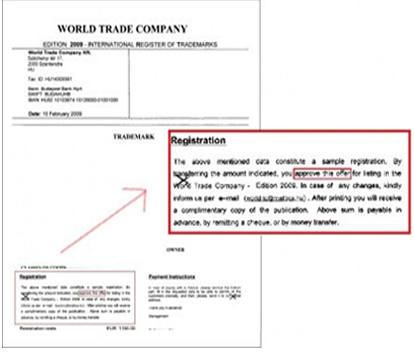

A ghost invoice is a bill 'disguised' as an offer for any product or service. This is most likely non-existing software. That it is an offer can only be noticed if the fine print on the "account" is properly read.